Navigating Beyond the US Inflation Crisis

The resurgence in investor confidence is vividly reflected in the stock market’s recent performance, particularly the S&P 500’s upward trajectory. This index, a key barometer of the market’s health, has seen significant gains, indicating that investors are regaining faith in the market’s potential. The rise in stock prices is not just a short-term blip but a sustained improvement, underscoring the recovery from the lows experienced earlier. This positive trend in the stock market is seen as a hopeful sign of economic recovery, buoying sentiments across sectors.

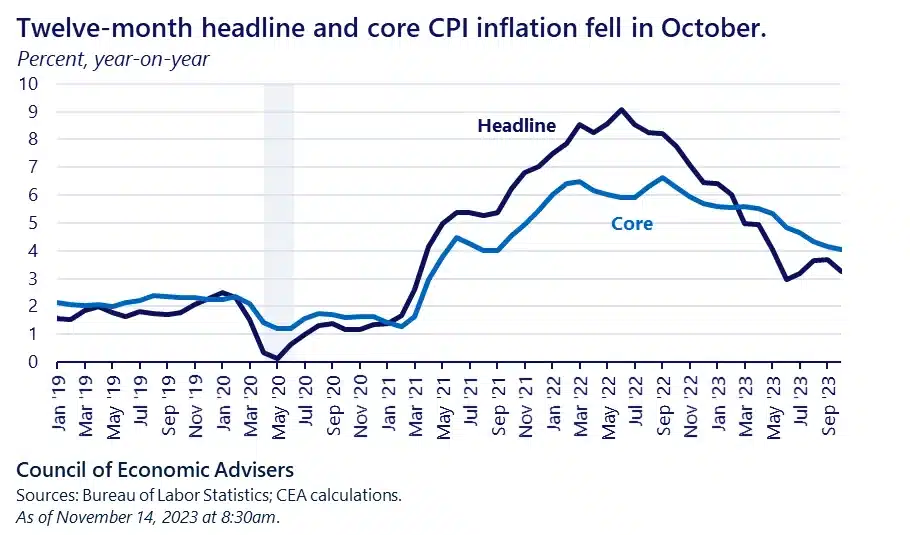

Easing Inflation Concerns

The Consumer Price Index, a crucial measure of inflation, shows a gradual but steady slowdown. This change signals a pivotal shift in the economic landscape, moving away from the high inflation rates that have been a significant concern for policymakers and the public. The easing of inflation is a complex phenomenon influenced by various factors, including policy measures, global economic trends, and shifts in consumer behavior. This slowdown in inflation suggests that the efforts to stabilize prices are bearing fruit, providing much-needed relief to consumers and businesses alike.

Relief at the Pump

The significant drop in gasoline prices has been a major relief for consumers. This decline is particularly impactful because gasoline prices are an obvious cost that affects most people regularly. The downward trend in fuel costs contributes to a broader sense of economic relief and is vital in shaping public perception of inflation. This cooling of prices at the pump results from various factors, including shifts in global oil markets and domestic energy policies. For many, this decrease in gasoline prices represents a tangible sign of easing inflationary pressures.

Changing Consumer Expectations

As evidenced by various surveys, the shift in consumer inflation expectations points to a growing sense of optimism about the economy. Consumers, who once braced for continued high inflation, are now adjusting their outlook, expecting more moderate price increases. This change is crucial because consumer expectations can influence spending habits and, in turn, impact economic growth. The decline in inflation expectations is a positive sign, suggesting that consumers feel more confident about their financial prospects and the overall economic direction.

Corporate Outlook on Inflation

Business leaders increasingly express less concern about inflation, a significant change from the heightened worries seen in previous months. This shift in corporate sentiment is critical as it influences investment decisions, pricing strategies, and overall business planning. Reduced discussions about inflation in earnings calls and corporate statements indicate that businesses are beginning to see a more stable pricing environment, which is essential for long-term planning and growth. This change in outlook is also a testament to the adaptability of businesses in navigating the complex economic landscape shaped by inflation.

Decline in Wholesale Prices

A notable decrease in wholesale prices suggests significantly easing inflationary pressures across various sectors. This trend is particularly important as it impacts the cost of goods at the production level, eventually influencing retail prices. The contraction in wholesale prices could be attributed to various factors, including improved supply chain efficiencies, reductions in raw material costs, and a stabilization in demand. This trend is a positive signal for the economy, indicating that the inflationary spike might moderate, leading to more stable prices for consumers and businesses.

Goldman Sachs’ Optimistic Forecast

Economists at Goldman Sachs have projected a continuing disinflation trend, expecting core inflation rates to reduce significantly by the end of 2024. This forecast analyzes current economic trends, including the normalization in product and labor markets. The expectation that core inflation will fall back to around 2-2.5% is a significant indicator of economic stability and recovery. Such forecasts play a crucial role in shaping economic policies and guiding investment decisions, offering a beacon of hope for an economy seeking to rebound from the challenges of high inflation.

Retail Sales Cool Down

A slight decrease in retail sales signals a cooling period in consumer spending. This trend might reflect a more cautious approach by consumers in the face of economic uncertainties. While the decrease is modest, it’s an important indicator of consumer behavior, a key driver of economic growth. Being susceptible to consumer sentiment, the retail sector provides valuable insights into the overall economic climate. Understanding the nuances behind this decline in retail sales is crucial for businesses and policymakers as they navigate the complex interplay between consumer confidence, spending patterns, and economic health.

Retail Giants Face Mixed Fortunes

Major retailers like Walmart and Target have reported varied financial outcomes, reflecting the complex consumer spending behavior in the current economic climate. These mixed results from big box retailers indicate the nuanced shifts in consumer preferences and spending habits. Walmart’s cautious outlook and the seasonal fluctuations in sales underscore the evolving retail landscape. Target’s performance, bolstered by purchases in essential categories, highlights the consumer trend toward prioritizing necessities amid economic uncertainties. These patterns from major retailers offer valuable insights into the broader trends in the retail sector and consumer behavior.

Unemployment Claims and Employment Trends

The slight increase in unemployment claims, while indicative of fluctuations in the job market, continues to trend at levels associated with economic growth. Despite these minor uptick in claims, the employment sector’s resilience reflects the underlying strength and adaptability of the labor market. This aspect is crucial as employment levels directly impact consumer spending, business investment, and overall economic momentum. The job market’s stability is key to maintaining economic growth and consumer confidence during economic uncertainty.

Frequently Asked Questions about the Inflation Crisis

What does the recent performance of the S&P 500 indicate about the stock market?

The recent uptick in the S&P 500 reflects a resurgence in investor confidence, signaling a positive shift in the stock market and suggesting an overall economic recovery.

How has the Consumer Price Index (CPI) changed, and what does this mean for inflation?

The CPI shows a gradual slowdown in inflation, indicating that inflation rates are stabilizing and providing hope for more controlled economic conditions.

What impact has the decrease in gasoline prices had on the economy?

The significant drop in gasoline prices has been a major relief for consumers, affecting public perception of inflation and contributing to broader economic relief.

Are businesses still concerned about inflation?

A noticeable decrease in corporate discussions and concerns about inflation reflects a more stable pricing environment and an improved outlook for future business planning.

How is consumer spending behavior impacting the retail sector?

Slight declines in retail sales signal a cooling in consumer spending, reflecting a cautious approach by consumers amidst economic uncertainties and impacting the retail sector’s performance.

What do recent employment trends suggest about the job market?

Despite a slight rise in unemployment claims, the job market shows signs of stability and growth, indicating resilience and adaptability in the face of economic changes.